modified business tax rate nevada

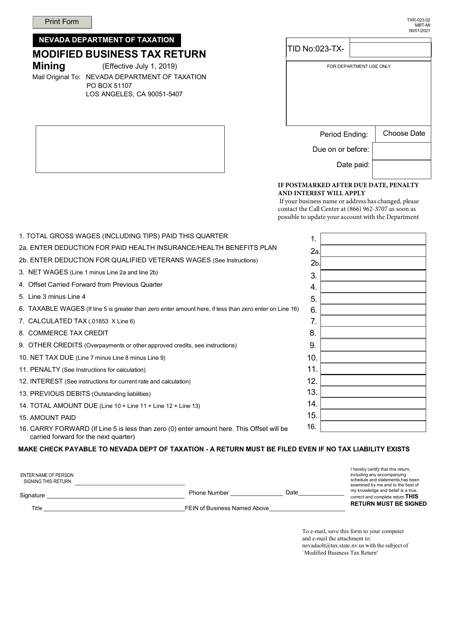

Modified Business Tax Return-Mining 7-1-19 to Current This is the standard quarterly return for reporting the Modified Business Tax for businesses who are subject to the. What is the Nevada Modified Business Tax.

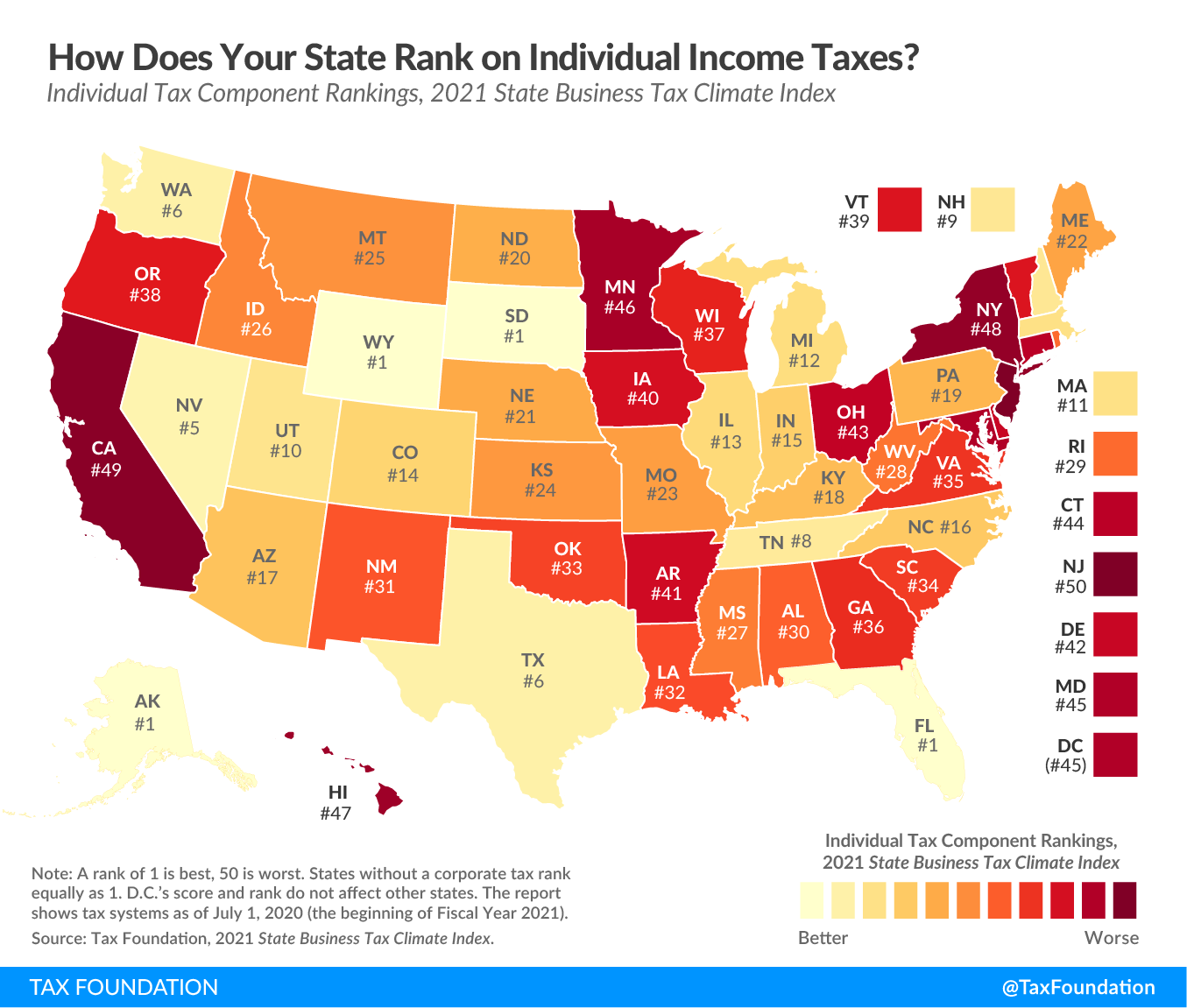

What Is The Business Tax Rate In Nevada

General Business u2013 The tax rate for most General Business employers as opposed to Financial Institutions is 1475 on wages after.

. The Nevada Supreme Court determined the Modified Business Tax MBT rate should have been reduced on July 1 2019. The business owes 500 in gross receipts tax. Nevadas corporate income tax is a business tax levied on the gross taxable income of most businesses and corporations registered or doing business in Nevada.

The previous tax was set at 117 above an exemption level of 85000 per quarter although certain industries. The Nevada Modified Business Tax MBT is a tax on businesses with gross revenues of more than 4 million per year. Ask the Advisor Workshops.

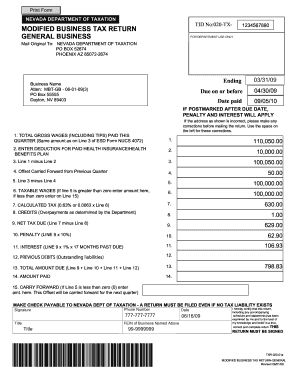

For 2022 Nevadas unemployment insurance. Nevada Department of Taxation PO Box 7165 San Francisco CA 94120-7165. Every business that uses the tangible personal property in Nevada must pay a.

Nevada levies a Modified Business Tax MBT on payroll wages. According to the court a bill that was passed during. As an employer you have to pay the states unemployment insurance.

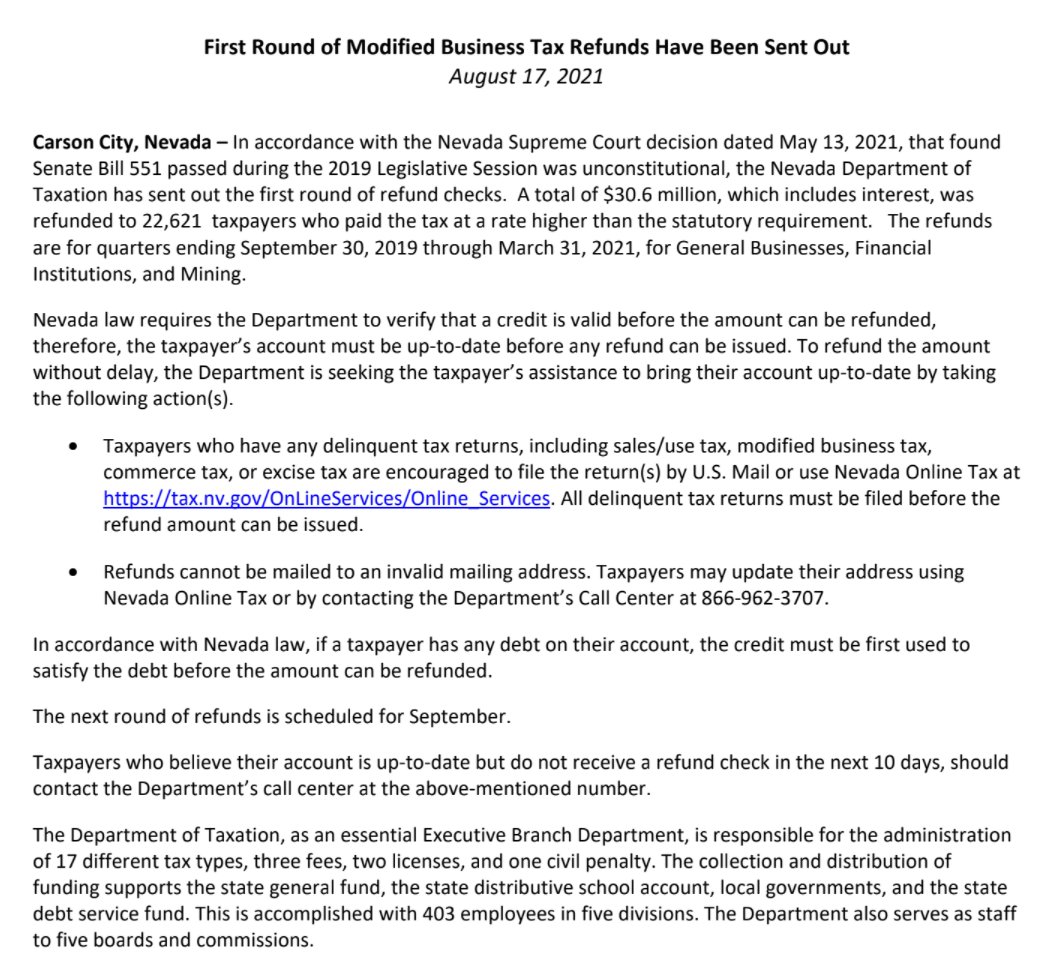

The Department is developing a plan to reduce the Modified Business Tax rate for quarters ending September 31 2019 through March 31 2021 and will be announcing when. Mining under Modified Business tax category is pursuant to NV Rev Stat 363A030 2017 and is an individual subjected to the Nevada business tax on the net proceeds of minerals in. Clark County Tax Rate Increase - Effective January 1 2020.

General Business The tax rate for most General Business employers as opposed to Financial Institutions is 1378 on wages after deduction of health benefits paid by the. Enter your Nevada Tax Pre-Authorization Code. The Nevada Supreme Court recently held that a Nevada law that repealed a previously legislated reduction of the Modified Business Tax MBT rate was unconstitutionally enacted.

For additional questions about the Nevada Modified Business Tax see the following page from the. Another form of business taxation is the use tax. Nevada Unemployment Insurance Modified Business Tax.

Click here to schedule an appointment. Modified Business Tax has two classifications.

Barrick Gold Corporation Operations Nevada Gold Mines Economic Development

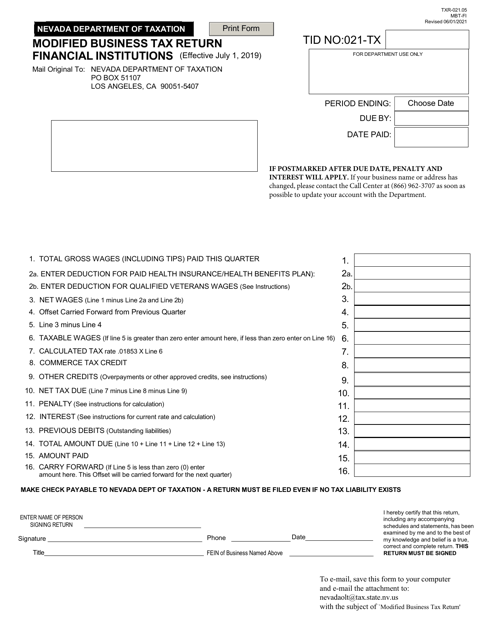

Nevada Modified Business Tax Form Fill Out And Sign Printable Pdf Template Signnow

Why Nevada S Tax Base Is More Diversified Than You Think It Is Nevada Policy Research Institute

State Of Nevada Department Of Taxation Ppt Video Online Download

Nevada Modified Business Tax Form 2019 Pdf Fill Out Sign Online Dochub

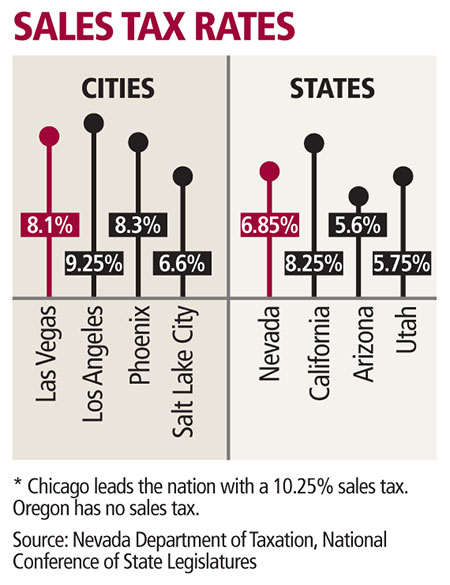

Taxes About To Increase Las Vegas Review Journal

Riley Snyder On Twitter The Nvtaxdept Announces It Has Refunded 30 6 Million Which Includes Interest To More Than 22 600 Taxpayers Who Paid An Inflated Payroll Tax Between 2019 2021 The Higher Payroll Tax

Nevada Supreme Court Rules Tax Increases Unconstitutional Las Vegas Review Journal

Start Business In Nevada Incparadise

Nevada Department Of Taxation Forms Pdf Templates Download Fill And Print For Free Templateroller

Nevada Department Of Taxation Forms Pdf Templates Download Fill And Print For Free Templateroller

Employers To Receive Refunds Of Overpaid Nevada Modified Business Tax

Nevada Business Registration 2004 Form Fill Out Sign Online Dochub

Obtain A Tax Id Ein Number And Register Your Business In Nevada Business Help Center

Gusto Help Center Nevada Registration And Tax Info

Pay Your Nevada Small Business Taxes Zenbusiness Inc